US Jobs Miss Expectations as Labour Market Shows Signs of Cooling

Summary

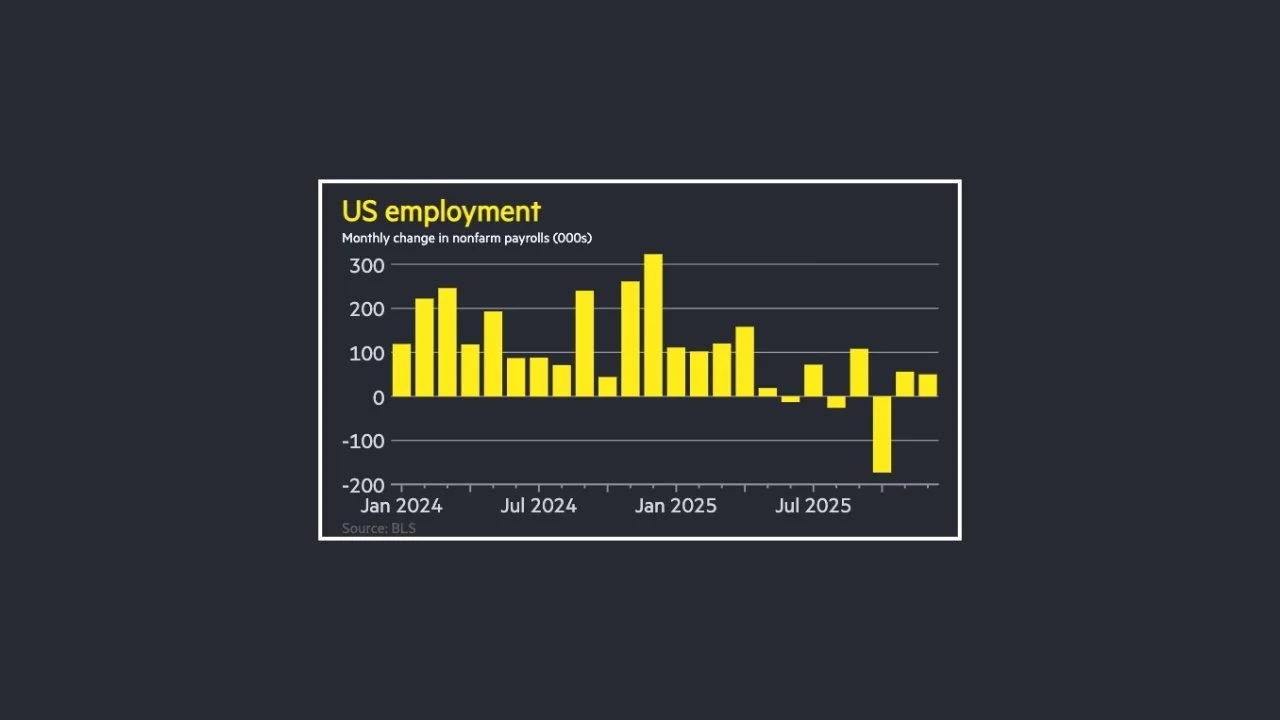

US job growth missed expectations in December, reinforcing signs that the labour market is cooling rather than collapsing.

A surprise drop in the unemployment rate has complicated the Federal Reserve’s next policy decision.

Markets are increasingly pricing a pause in rate cuts as policymakers wait for clearer economic signals.

The US economy added just 50,000 jobs in December, falling short of expectations and pointing to a clear slowdown in hiring momentum. The result reinforces the view that the labour market is cooling after several years of strong post-pandemic growth.

Economists had forecast closer to 70,000 new jobs, making the shortfall difficult to ignore. For investors, weaker job creation often signals softer economic activity heading into the new year.

Despite slower hiring, the unemployment rate unexpectedly fell to 4.4 per cent from November’s revised 4.6 per cent. This combination of slower job growth and lower unemployment highlights a labour market losing speed without showing outright stress.

Recent data revisions have added to the uncertainty. November’s jobs figure was revised down again, reinforcing the idea that employment growth has been softer than initially reported.

Markets reacted cautiously, with short-term Treasury yields ticking slightly higher following the report. Investors appear focused on the lower unemployment rate rather than the headline job creation miss.

The data adds to growing evidence that federal job cuts and weaker private-sector hiring are weighing on employment growth. This trend is becoming harder for policymakers to dismiss.

The Federal Reserve has already cut borrowing costs at its last three meetings, bringing rates to a three-year low. However, officials have made it clear that further cuts are no longer automatic.

Comments from policymakers suggest rates are now “well positioned,” raising the bar for additional easing. The latest jobs data strengthens the argument for a pause at the Fed’s next meeting.

Economists broadly agree the labour market is slowing but not breaking. For now, the balance of evidence points to caution rather than urgency from the central bank as 2026 unfolds.