Congress Faces Vote on Stock Trading Ban for Lawmakers

Summary

A vote is scheduled in 19 days on legislation that would ban members of Congress from buying or selling stocks.

The proposal aims to address long-standing concerns around conflicts of interest and market fairness.

If passed, the rule could reshape how investors interpret political risk and market-moving disclosures.

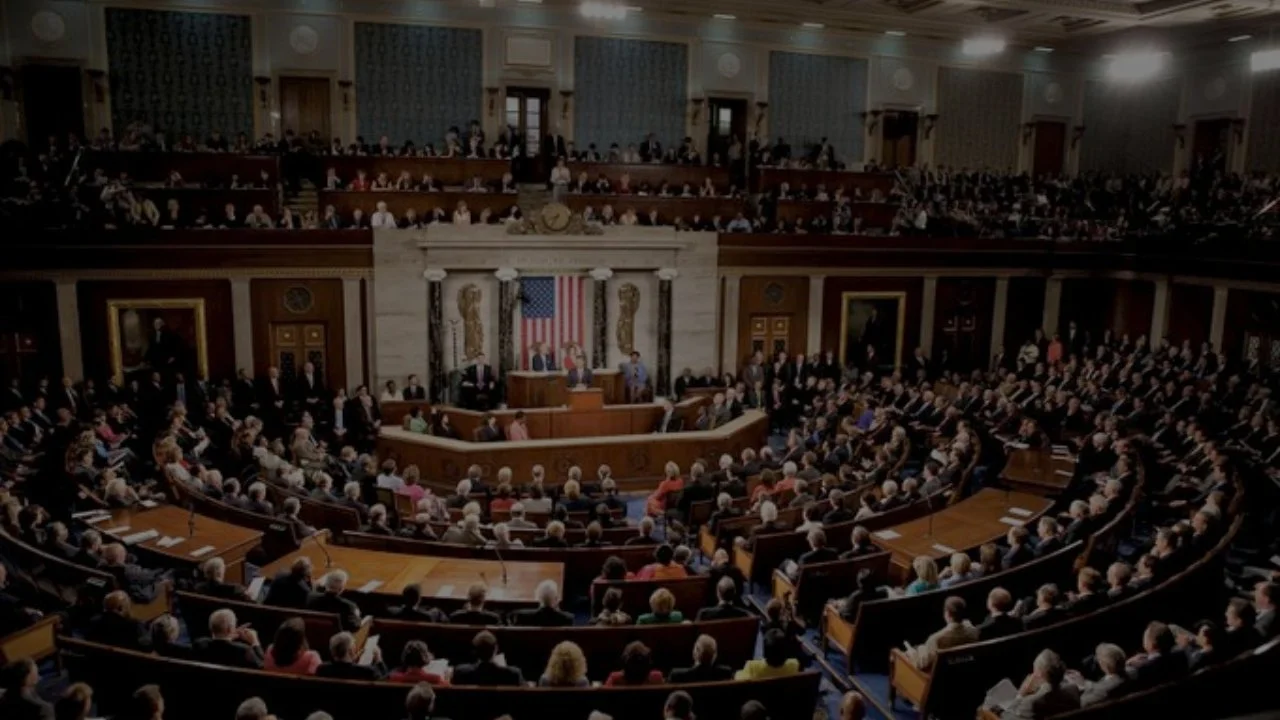

The U.S. House of Representatives has a vote scheduled in 19 days on legislation that would ban members of Congress from buying or selling stocks. The proposal targets a long-running issue that has drawn criticism from both retail and institutional investors.

Concerns around lawmakers trading stocks while shaping policy have intensified in recent years. High-profile disclosures have raised questions about whether political insight provides an unfair market advantage.

Supporters of the ban argue it would restore trust in financial markets and public institutions. They see it as a clear step toward separating personal financial gain from legislative influence.

Opponents have raised concerns about personal financial freedom and enforcement complexity. Some lawmakers argue disclosure rules already provide sufficient transparency.

For investors, the vote matters beyond politics. A ban could reduce speculation around policy-driven stock moves and lower the noise created by congressional trade disclosures.

Market sentiment often reacts sharply to trades revealed by elected officials. Removing this factor may slightly dampen short-term volatility tied to political headlines.

The legislation could also influence how future policy risk is priced into equities. Investors may place greater focus on fundamentals rather than political positioning.

With the vote approaching, attention is building across financial media and trading communities. The outcome could mark a significant shift in how markets intersect with U.S. politics.